Individual Tax Rates 2025 South Africa - Individual Tax Rates 2025 Calculator Fayre Jenilee, Granting income tax relief by adjusting brackets and rebates for the effect of inflation. Calculate your personal income tax for 2025/2025. Dublin V Kerry 2025 Full Match Free. The old rivals will meet again in a battle for sam this weekend. Watch your favourite channel anywhere, anytime, online ! The match

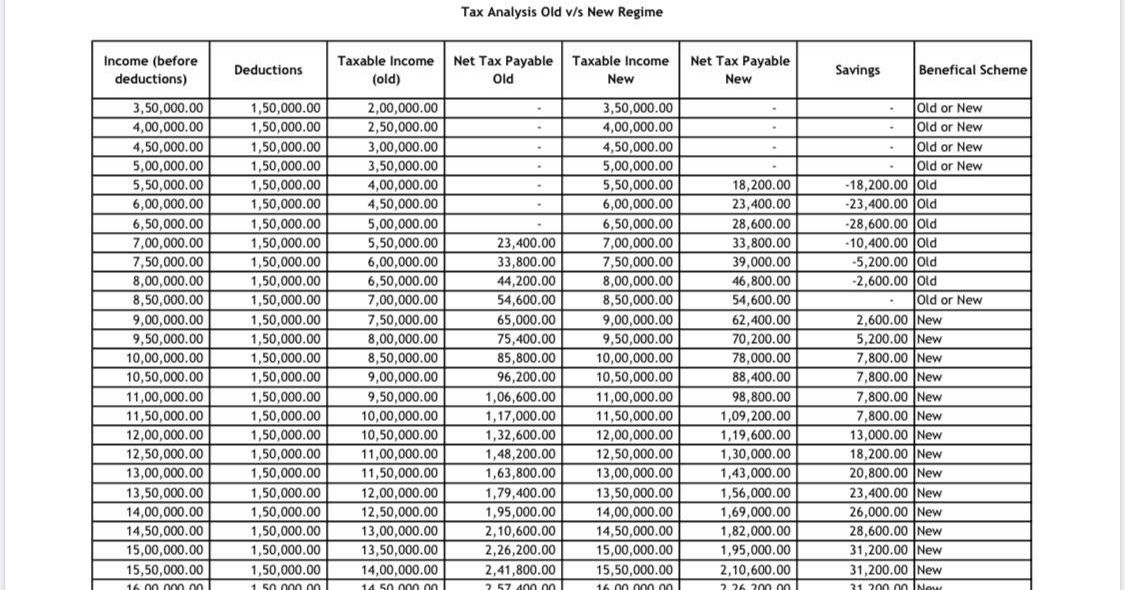

Individual Tax Rates 2025 Calculator Fayre Jenilee, Granting income tax relief by adjusting brackets and rebates for the effect of inflation. Calculate your personal income tax for 2025/2025.

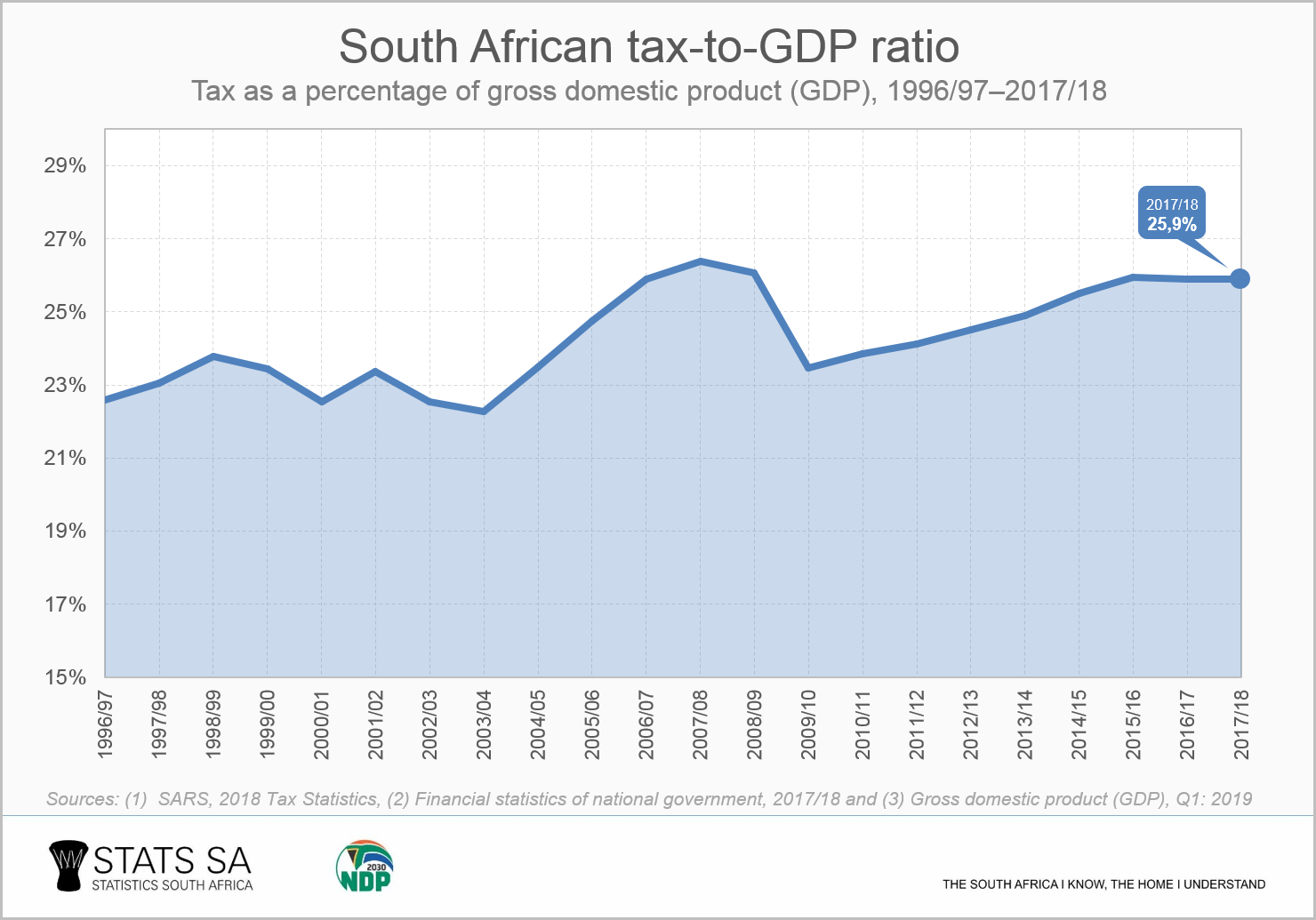

Tax Rates 2025 Catlee Cherish, 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa. 0 1k 2k 3k 4k tax 2025/23 2025/25.

Individual Tax Rates 2025 South Africa. On this page you will see individuals tax table, as well as the tax rebates. R251,258 + 41% of taxable income above r857,900.

Copa Sudamericana 2025 Final. El #sorteo de las octavas de final de la #conmebol #sudamericana 2025.suscríbete al canal oficial de la conmebol sudamericana para tener acceso al mejor cont. Conmebol

Tax rates for the 2025 year of assessment Just One Lap, R179,147 + 39% of taxable income above r673,000. 2025 tax year (1 march 2025 to 28 february 2025).

Use our online income tax calculator designed for individuals to help you work out your estimated monthly take.

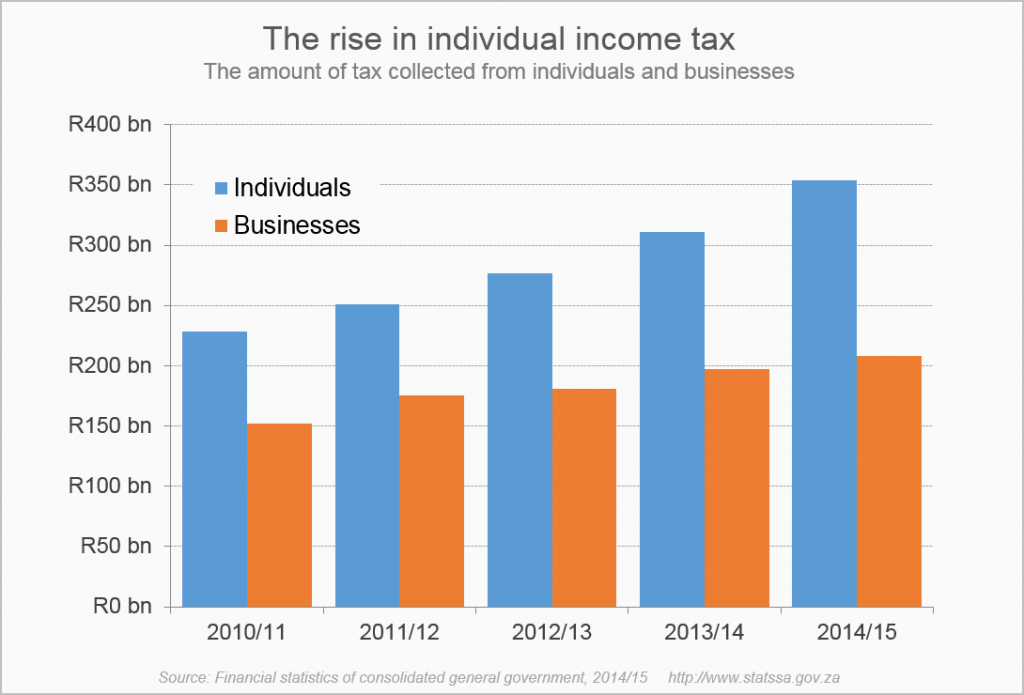

tax This is what you’ll pay Moneyweb, Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year. R251,258 + 41% of taxable income above r857,900.

Notes On South African Tax 2025 Image to u, Your monthly sars income tax comparison: To see tax rates from 2025/5, see.

Individual Tax Brackets 2025 South Africa Britte Maurizia, 15 july 2025 to 21. R179,147 + 39% of taxable income above r673,000.

The personal income tax phase of filing season 2025 commences. And this window runs till 21 october 2025.

A breakdown of the tax pie Statistics South Africa, The rates of tax chargeable on taxable income are determined annually by parliament, and are generally referred to as “marginal rates of tax” or “statutory rates”. Sars provided details about the 2025 filing season dates.